The results of the business risks survey “Allianz Risk Barometer 2022”, which is regularly conducted every year by Allianz Global Corporate & Specialty (AGCS-one of the world’s largest insurance and financial investment companies in Munich, Germany) has been announced.

Annual global business risks survey, the 11th of which was published in 2022: Allianz Risk Barometer 2,650 people from 89 countries and regions; It was created by the input of a community of risk managers, brokers, CEOs and insurance professionals.

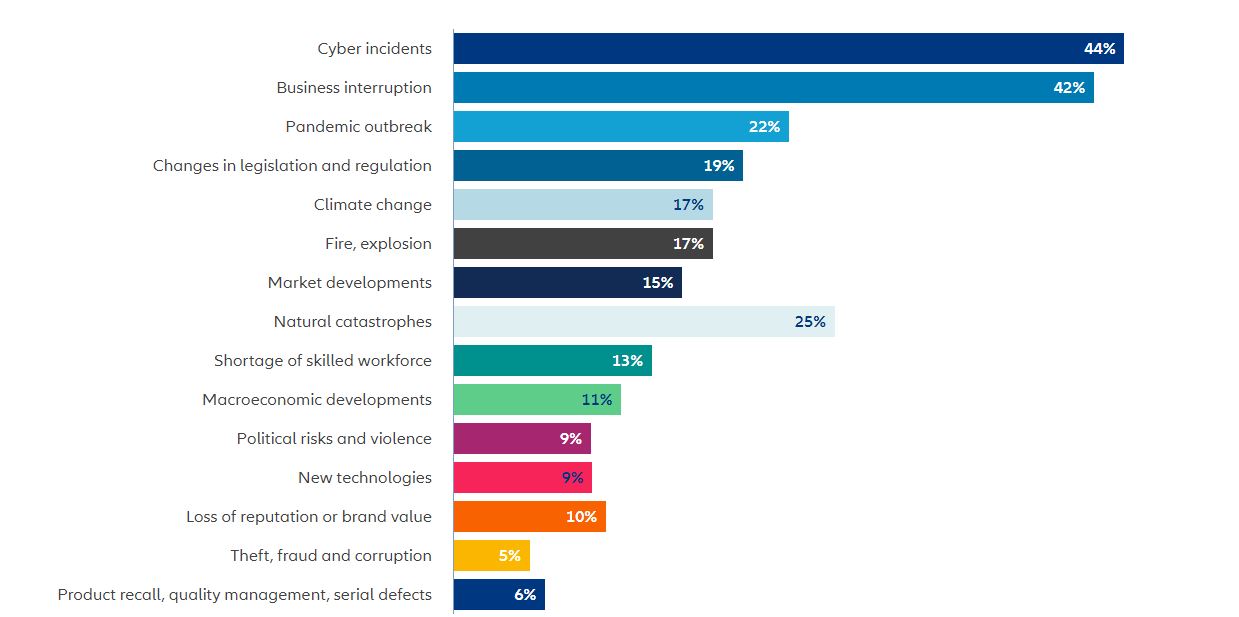

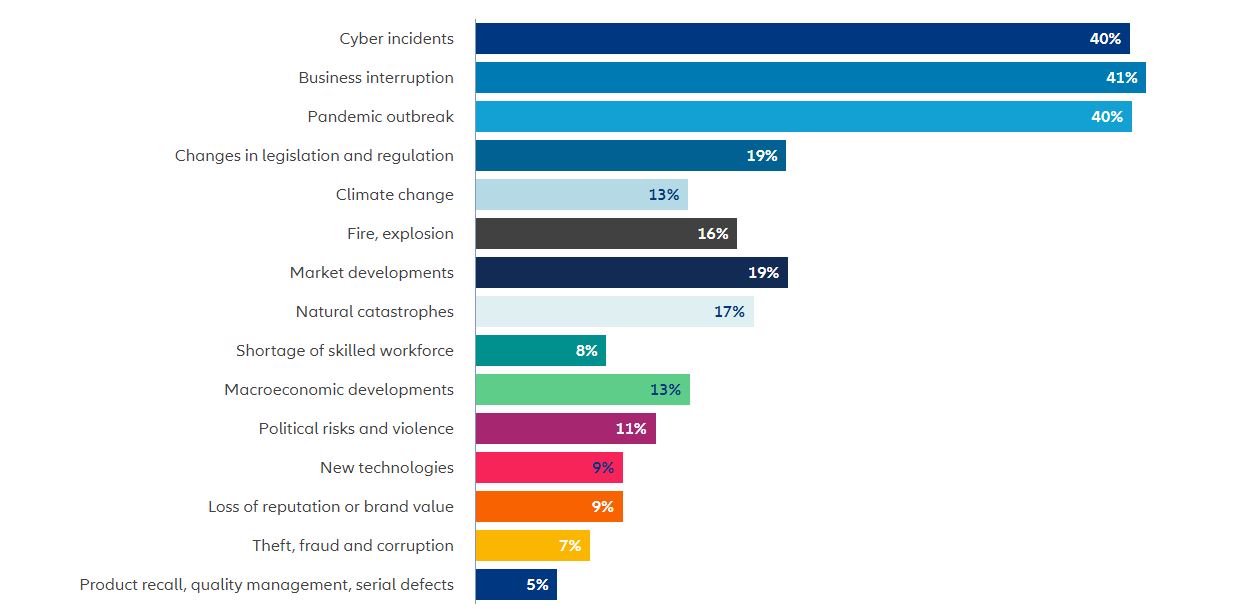

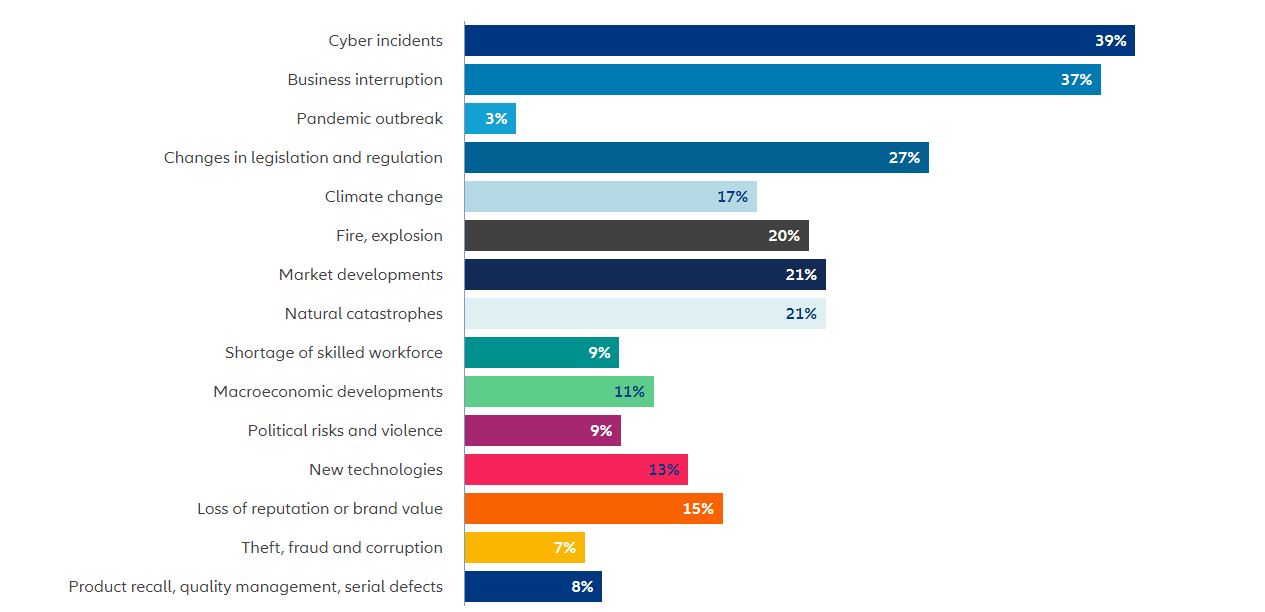

While cyber incidents, business interruptions and natural disasters are the 3 most important risks in the survey results, one of the most striking aspects of the study is that cyber incidents, which are in the 3rd place with 40% of the votes according to the 2021 survey, this year with 44%, business interruption ( 42%) and natural disasters (25%) and ranked first. According to the report published in 2020, cyber events had ranked first with 39% of the votes.

When the route of the survey results was turned to Turkey, the most important business risk that came to the fore was business interruption with 71%. Macroeconomic developments ranked 2nd with 47%, natural disasters ranked 3rd with 35%, while changes in legislation and regulations, climate change, political risks and violence came after the first three risks with a rate of 24%. Cyber incidents and epidemics took their places in the survey list with 18%, fire, explosion and market developments with 12%.

Allianz risk barometer and cyber attacks

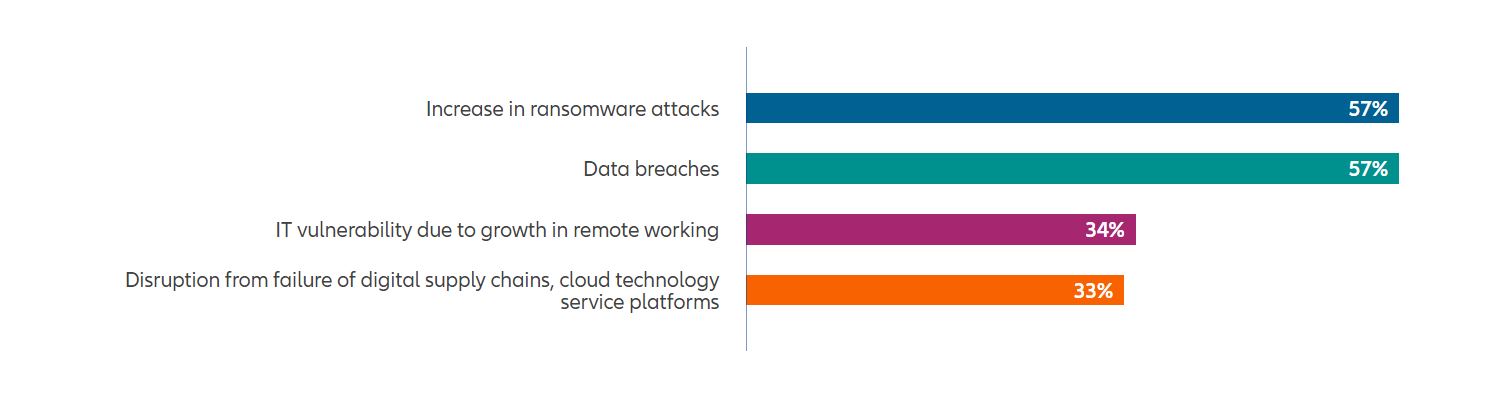

Artan dijitalleşme ve uzaktan çalışma sonucu olarak, siber olaylar bu yılın en önemli iş riski haline geldi. Özellikle son yıllarda siber tehdit ortamına hakim olan fidye yazılımları, 2022 yılı Risk Barometresi’nde %57 lik oy oranı ile en çok endişe duyulan siber tehdit olarak açıklandı. Fidye yazılımının hemen ardından veri ihlalleri geliyor. Siber olayların, iş risklerinde ilk sırada yer alması ve fidye yazılımı ile veri ihlallerinin bu riskler arasında başı çekmesi, ISO 27001 gibi standardizasyonların ve PDFA’nın önemini bir kez daha ortaya koyuyor.

In the article published based on Allianz Risk Barometer of 2022; It was emphasized that ransomware has become a business for cybercriminals who make it easier to overcome obstacles by improving their techniques and methods. Criminals with little technical knowledge are able to carry out ransomware attacks for as little as $40 a month, using cryptocurrency to avoid getting caught.

AGCS Küresel Siber Başkanı Scott Sayce;

The commercialization of cyber crime has made it easier for criminals to exploit vulnerabilities on a massive scale. Previously, hackers typically targeted specific industries that dealt with personal data, such as healthcare and retail, but ransomware attacks are indiscriminate, affecting organizations across all sectors, public and private, both large and small.

said.

Increased vulnerability (34%) and disruptions to digital supply chains and cloud platforms (33%) due to remote working ranked third and fourth among cyber risks of concern in this year’s Allianz Risk Barometer.

I am afraid we will see more attacks against technology supply chains and critical infrastructure – they are a logical response to organizations ramping up their cyber security, protections and responses. “It is also likely that we will see hardware being subverted and injected into IT supply chains, and this is a scenario organizations should prepare for.

Cyber hygiene really does matter for Allianz

AGCS now evaluates every insurance application it receives according to cyber security posture criteria. Assessments consist of proactive technology checks such as endpoint protection and multi-factor authentication, as well as regular backups, patching, training, business continuity arrangements and crisis response capabilities.

“The role of insurance has always been to ensure good risk management and loss prevention,” says Sayce. “Good cyber maturity and good cyber insurance go hand-in-hand. We buy insurance for our home, but this does not mean we leave the front door unlocked, and the same should be said for cyber security.”

Even when companies follow best practices and implement technical solutions, systems can still be compromised. Pre-event planning and preparation – such as incidence response planning, scenario testing, and board wargaming – are critical to minimizing the impact of a cyber-attack.

“It is important that we constantly challenge and test our plans. When we look at our submissions, most companies have business continuity plans, but less than 40% test them,” says Sayce.

Source: https://www.allianz.com/en/press/news/studies/220118_Allianz-Risk-Barometer-2022.html

[vc_row][vc_column][vc_cta h2=”” add_button=”bottom” btn_title=”Teklif Talep Edin” btn_style=”flat” btn_shape=”square” btn_color=”danger” css_animation=”fadeInLeft” btn_link=”url:https%3A%2F%2Fcyberartspro.com%2Fteklif-isteme-formu%2F||target:%20_blank|”]Siber Güvenlik, Dijital Dönüşüm, MSSP, Sızma Testi, KVKK, GDPR, ISO 27001, ISO 27701 ve DDO Bilgi ve İletişim Güvenliği Rehberi başlıklarıyla ilgili teklif almak için lütfen tıklayın.

[/vc_cta][/vc_column][/vc_row]